What is Pips & Spread in Forex Trading-The Anatomy of a Forex Quote

Previous Article and introduction to the forex markets we looked at an example of the Euro against the British Pound exchange rate in this Article we’re going to look at a different currency pair we’re going to look at the Euro against the US dollar and use that as our starting point to explore a Forex quote so let’s take a closer look at Europe against US dollar so the Euro against the US dollar in our previous article when we looked at exchanging British pounds into euros and then back again we said that currencies are represented by three letter codes for the currency in that for the euro it was EUR and we said for the pound it was GBP for the US dollar its USD all quite straightforward.

We write it with this slash in the middle and Euro against US dollar is the most traded currency pair in the world so it’s the most important currency pair in the forex market has the highest volumes and when we write a currency pair like this the first name currency is what’s known as the base currencies or in this case that is the Euro we usually write it with this slash and then the second name currency the US dollar in this case is known as the counter currency or the quote currency or sometimes as the secondary currency when we have an exchange rate for currency pair whatever that might be let’s say it’s 1 point 200 something like that this is the number of the counter currency that should get for one unit of the base currency more from the not when a currency pair contains the US dollar.

The dollar usually goes first the exception though is when it’s against the euro or the British Pound and for those the convention is usually to quote the euro and the pound as the base currency and have the US dollar as we have it here as the counter currency they can be quoted either way though which round it is is vitally important because that defines the rate and if you are buying a currency pair you are buying the first named currency and you’re selling the second named currency so you need to pay attention to which way round it is being quoted so having introduced a year against the US dollar currency pair let’s take a look now at how euro dollar looks within trading to ones whose webapp here I am in trading to one twos web app.

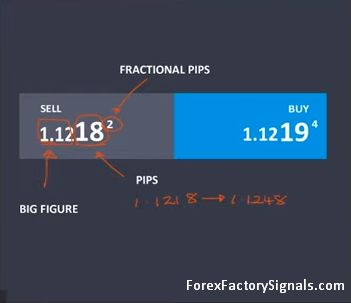

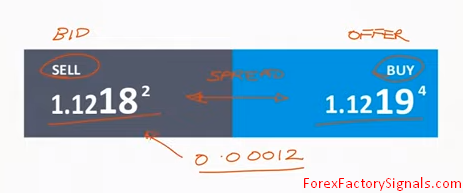

I’m looking at a chart of Euro against US dollar and what I’m going to do is just right click here and click open detail trade books just so that we can look at the price that we can trade out for Euro against US dollar so I’ve clicked on that and we can see that there’s a sell and a buy price and they’re slightly different prices a sell price is one point one two one eight but this little two and then buy price is one point one two one nine with this little four so with this ordered ticket there’s all sorts of things going on lots of things to look at but for the time being all that I’m really interested in is the price you can sell at and the price that you can buy at and we call this the bid and offer so let’s take a closer look at these two prices and what they mean so the bid is the price that you can sell at.

it is always the lower of the two prices in a quote the offer sometimes also called the ask is the price that you can buy at now it is always the higher of the two prices in a quote the difference between the bid and offer it’s what’s known as the bid-offer spread we can see here that the size of that spread is not point naught naught naught 12 if we add that number on to this bid of 1 point 1.2182 then we end up with this offer price of 1 point 1.2194 now we said in the previous video where we introduced a forex market at the core of the forex market is the interbank forex market a kind of wholesale level of forex trading where very large banks are exchanging currencies with each other in the interbank market.

The primary banks will have markets makers providing prices at which these banks are willing to take deals in various currencies for example euro dollar as we have here one way that a markets maker may turn a profit is from the spread that they quote so let’s just take a look at a very simplified example to try and illustrate this so let’s say that this is a market maker and they spit off a quote that we’ve already been looking at is a bit of a spread that they’re quoting implied in this is that there is a midpoint between this bid and offer and that may or may not represent the actual euro dollar rate because the market maker may be pricing this cheaply to try and attract buyers or pricing a slightly more expensively to try and attract sellers but for the purposes of simplicity let’s just say that they have priced their quote exactly where they think the exchange rate actually should be.

They just applied a bit off as spread around it now let’s say then that they have a buyer at the offer in size X and then next they get a seller and the bid in size X the same size exactly the same size if these are the only two orders on their book that they’ve taken then they themselves this market make it has no exposure at this point to the exchange rate but they have collected this spread that we said was north point naught naught naught 12 multiplied by that deal size X and they will have collected that as their profit so that’s the bit of a spread now the increments in which prices move is important conventionally in the forex market forex prices were quoted to a certain number of decimal places and the last decimal place under this convention was the smallest increment in which prices could move and this was called a pip so let’s take a closer look at pips and also fractional pips.

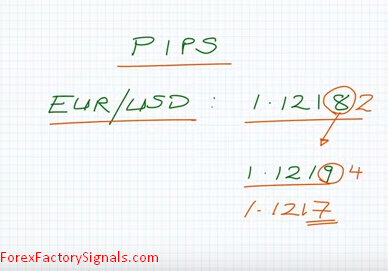

So with pips we need to look at what was the conventions in the forex market now for year $1 the price that we’ve been looking at conventionally that was quoted to four decimal places so we might look at a quote that was 1.1 to 1/8 this last decimal place the smallest increment and change you could have would be at one point changing this at one pip change so if it went from one point one to one eight to one point one two one nine that’s increased by one pick or if it went down to one point one two one seven that would have been a decrease of one pip with online brokers these days you tend to get an extra decimal place well and that’s referred to as a micro pip or a fractional pip in the case of the quotes we’ve been looking at we had a two here and we had a four here but these are not pips they’re fractional pips looking quickly within trading to ones whose webapp again this is a trade box again for a year against US dollar.

If you look at the quotes here you’ll notice that the number as they are shown in the web app they’re presented with the numbers and different sizes some are much smaller than the other some are larger so this is to help recognize pips and micro pips another thing that’s called the big figure so let’s take a look at that this is a representation of how a Forex quote shows in the app as we’ve just been looking at and this is the same bit of a quote that we’ve been using throughout the video so this small number here is the number of fractional pips so this is the fifth decimal place for euro versus US dollar it’s north point two of a pip that we’re looking at here so one pip is the change in the fourth decimal place as we’ve already said but you’ll notice how the third and fourth decimal place are the largest numbers that we can see here this represents the conventions of how these numbers that I talked about in the forex market so this is 18 pips that were looking at here on a forex trading floor this quote without bothering with fractional pips might just be given as 18 at 19 and he might be expected to have a handle on what is known as the big figure which is this part here so if the price increased from 1 1.218 to 1.1248 we would say that the price has risen by 30 pips.