The Costs Of Opening And Holding A Forex Trade-Forex Factory Signals

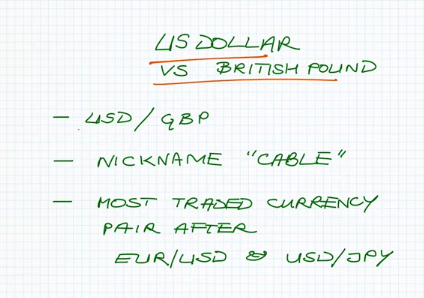

We looked at some trading examples of going long a Forex pair and going short what you also need to take into account when you’re trading the Forex position is the cost of holding the positions what we’re going to do is going to start off by looking at the pound against the US dollar talked a little bit about that and then use that and a starting point to explore this other facet of holding a Forex position the US dollar versus the British pound is one of the most popular currency pairs as we established in some of our earlier videos the three-letter code for the US dollar is USD and the three-letter code for the pound is GBP and so we write dollar against the pound as USD / GBP like that and the nickname for the currency pair is cable that’s the term that dates all the way back to the 19th century is derived from when the pound against the dollar exchange rates but first being transmitted across the Atlantic by telegraphic cable on the seabed on FX desks and trading floors.

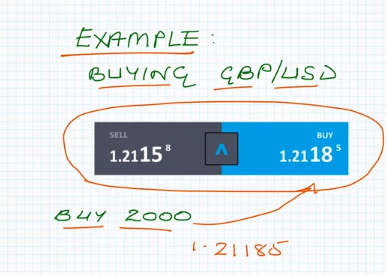

Cable is a very common slang term for gbp/usd and cable is the most traded currency pair after euro dollar and dollar-yen euro dollar is the most traded dalian holds the number 2 spot and cable is in third place so let’s now quickly run through an example of a cable trade and let’s look at buying the pound against the dollar so let’s say this is the way the bid-offer spread is looking and the two decided by two and at that offer price you’re buying 2,000 at one point two one one eight five and as always that’s two thousand of the first-named currency which is pounds so you buying two thousand pounds.

So having bought 2,000 pounds of cable what does that mean in terms of price movements well I’ve written the exchange rate here with the five smaller than the other numbers to show that that is the number of fractional pips or micro pips as we introduced in one of her earlier videos in this series and if we had a change in this decimal place that would be a change in one pip if it moved up by one number so one pip is as it is for so many other currency pairs nerds point naught naught naught 1 and that is for cable dollars per pound so if we multiply our two thousand pound deal size by the value of one pip that will show us what one pip movement will mean for our deal size so 2,000 pounds x naught point naught naught naught 1 dollar per pound no point one here would have been a tenth this would be a hundredth or thousandth so this is a ten thousandth so 2000 x one ten thousandth should equal nor point two dollars or as I’ve written here 20 cents per pip movement.

Let’s now say that six days later the price has changed and this is what the bid offer is looking like so you decide to close your position you do that by selling at the bid you sell two thousand pounds to close your position the same sizes you have open so you sell two thousand pounds at one point two two two three five to close so as we just said our closing level is one point two two two three five and our opening level was one point two one one eight five so if we subtract the opening level from the closing level we can work out a number of pips that we made we know how much we should have been making for each paper in there for we can work out our profits so if we look at these numbers these fives we subtract five for five just going to give a zero so we can ignore that if you put a line down here we know that one point two subtracted from one point two is going to be zero.

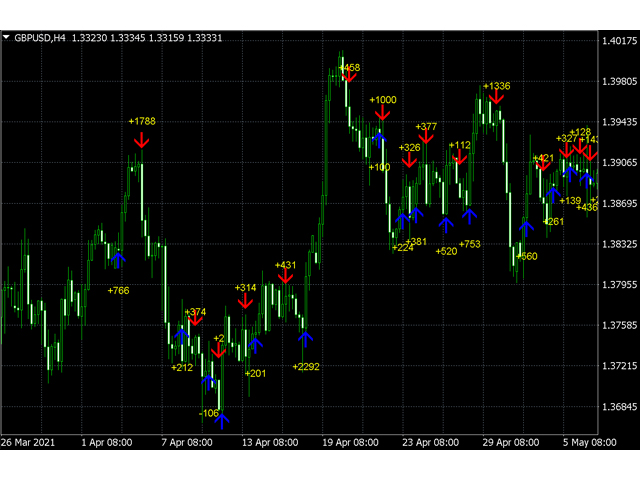

We can ignore that really we’re just looking at 223 pips – 118 pips and that gives us a difference of a hundred and five pips and we said before that one pip was 20 cents or Northpoint – of a dollar multiplied by a hundred and five and therefore over overall that is twenty-one dollars difference between our opening and closing level in terms of trading profit so we made a $21 trading profit but we also need to take into account the cost of holding the position so let’s quickly look in trading to ones whose web app now how we can easily find out what is called the swap cost full pound against the US dollar so here we are in trading – one two’s web app and we’re looking at the chart of pound against dollar cable.

What I’m going to do is go over to this eye icon in the top right hand corner for instrument details and click on that and then what we’re interested in are these swap costs here these swap charges there’s a shorts position swap and a long position swap now we had a long position so it’s the long position swap that we’re interested in and we can see that the value there is – no – point no what no no no what eight one so the long position swap value as we just said was naught point naught naught naught naught eight one and this is a cost in dollars per pound that you hold in terms of position size so let’s assume that this is constant for each of the six days that you hold the position.

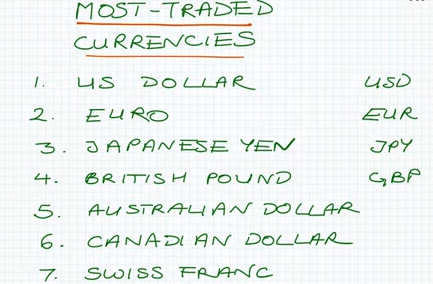

So the total swap charge is six days multiplied by that daily charge multiplied by the 2,000 pound quantity and those numbers will work out as 97 cents so we still made a profit overall just slightly less than the amount we’re just by looking at the opening and closing levels now we talked a little bit about your $1.00 about da Lian and now about cable in this series of videos and these are three of what we call the major currency pairs so let’s round this out by first looking at what are the major currencies and then looking at what are the major currency pairs before we move on to the major currency pairs let’s first take a look at what are considered the major currencies with this list of the most traded currencies in the world and this is based on the findings of the 2016 triennial central bank survey shows the rankings of these currencies buying markets turnover in first place.

We have the US dollar far and away the world’s most traded currency that goes hand in hand with its status as the global reserve currency we’ve already talked about the US dollar we know that it’s three lesser ISO code is USD euro is the second place we’ve already looked at its code in previous videos being EU R similarly for Japanese yen which is in third place we know that the code is JPY and in fourth place as we talked about earlier in this video the code is GBP and our fifth place currency we haven’t looked at yet in this series is the Australian dollar and it’s code is a you d the Canadian dollar in sixth place and it’s three-letter code is C a D and then in 7th place we have the Swiss franc and it’s ISO code is C H F all these currencies have in common that they have large economies for example the US dollar is the world’s largest economy and they’re all currencies for politically stable countries are in the case of the euro a politically stable economic area.

Major currency pairs are going to involve the currencies on this list having said that the major currencies have large economies in common I thought it might be interesting to look at a list of the world’s largest economies and this is a list by GDP using figures from the eye MF top of the pile we have the US there with the world’s largest economy but we do have a number of countries on this list that weren’t part of our list of the most traded currency so that would be China and India and Brazil and South Korea and Russia and these are normally labeled emerging currencies various reasons that may have contributed to them not seeing such high turnover in the forex market ranging from things such as political instability or the currency not being truly free floated in some cases.

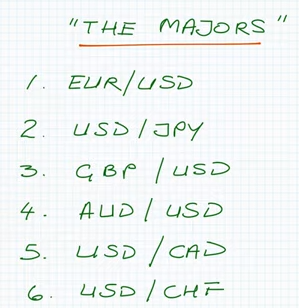

But if we look at which are the politically stable countries on this list we can see that our major currencies do crop up in kind of quite predictable fashion what is quite interesting is that Switzerland doesn’t make this top 11 and in fact the Chinese renminbi here in terms of turnover is actually not too far behind the Swiss franc based on that most recent triennial central bank’s survey and the major Forex pairs all involve the US dollar so each pair that’s in the list of the majors one of the currencies in the each pair is the US dollar they are the most heavily traded currency pairs and as a consequence get tighter spreads than pairs that aren’t the major Forex pairs and they are the most liquid Forex pairs in the forex market which is a very liquid market to start with so these are what I would consider to be the majors they are an order of volume traded and these are the six most traded currency pairs in the world number one euro dollar second dollar yen third place we have cable fourth the Aussie dollar against the US dollar with the US dollar against the Canadian dollar often is called dollar cad or the US dollar against the loonie and then in SiC we have dollar Swiss.