7 Benefits of Forex Trading-Forex Factory Signals

The basics of forex and that is trading with leverage or what we call trading on margin so let’s take a closer look now at trading margin trading way to leverage okay so in our rundown of the benefits of trading forex the first item then is leverage leverage allows control of a large value of currency by only having to deposit a small amount and this is what’s known as trading on margin so what we’re going to do is to run through an example using dollar Swiss to illustrate.

How trading on margin works and both the risks and benefits of leverage what we need to do first of all is to find out what the margin rate is for dollar Swiss and we can find this out from trading – 1 – zap so here we are in trading – one-twos we’re about looking at a chart of dollar Swiss if we ever want to find out some information about an instrument as a good chance we’ll find it by looking over here on the instrument detail.

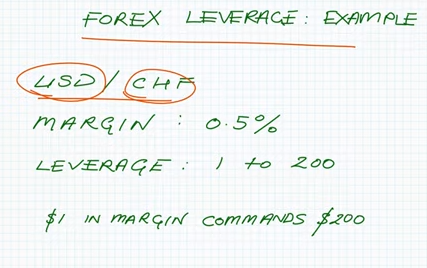

So I’m just going to click on there and it opens up this pane on the right hand side of the window and then the additional info section at the bottom there we can see margin is listed as half a percent that’s the margin rates that I use on my account which is as a professional investor if we just scroll down tiny bit further we can see the leverage there is one to two hundred so half percent margin gives us a leverage of one to two hundred .

Forex leverage example is going to be four dollar Swiss the US dollar against the Swiss franc and as we just saw the margin rate with trading to 1/2 is just half a percent for that currency pair for a professional client so that means you need to have deposited for a position just half a percent of the currency value of the underlying position now half a percent is one two hundred so the leverage is one to two hundred I $1.00 in margin it’s going to command $200 in underlying currency value and to give you a visual representation to try and illustrate this point they say that you use one thousand dollars as some margin.

So that’s represented by this highlighted section here that’s the thousand dollars that you’ve deposited on your account now for simplicity sake I’m just talking about dollars here because that’s the base currency for a dollar Swiss trade but of course the margin you deposit to your account would be in whatever currency your account its denominated in say pounds or euros or whatever now the leverage for dollar Swiss is one to two hundred as we’ve just seen so you can take a position that’s two hundred times larger than this amount so you could take a two hundred thousand dollar position that’s represented here by this much larger section you could take that position in dollar Swiss just by putting down that one thousand dollars.

Related : What is Pips & Spread in Forex Trading-The Anatomy of a Forex Quote

We do have to be clear here though trading on margin offers the convenience of putting down a small amount in order to command a much larger exposure but it is vitally important that you are aware at all times of the size of that underlying currency that you are commanding and that you’re aware of the risk that it entails so let’s just run through some very simple numbers to further illustrate this the Li bridge example so we said you could take a position of $200,000 let’s say that you choose to buy those two hundred thousand dollars of dollar Swiss at an exchange rate of let’s say naught point nine seven nine two.

Let’s say that the exchange rate increases and you’re able to sell out your position at a profit so you sell 200 thousand dollars of dollar Swiss at an exchange rate of let’s say naught two point nine 802 and one pip for dollar Swiss is naught point naught naught naught 1 so one pip is the fourth decimal place and so this is a ten pip increase in the exchange rate a 10 pip profit for you and when we say one pip is naught point naught naught naught 1 of the exchange rate that exchange rate is an expression of course of the number of Swiss francs that you get per unit of the base currency in the base currency being US dollars.

So that one pip is no point naught naught naught 1 Swiss francs per US dollar so your profit is a $200,000 transaction size multiplied by that pip value multiplied by the number of pips you made and so your profit if you work those numbers through works out as 200 Swiss francs at an exchange rate of naught point nine 802 that’s roughly about 204 US dollars in profit now if we were to take that $204 profit and then compare it to your $1,000 margin deposit the profit is greater than 20% of that margin.

Now if we think of an unleveraged version of the trade where you actually took two hundred thousand US dollars and converted it into Swiss francs and then back again for the same number of pips profit then the $204 expressed as a percentage of that two hundred thousand is going to be around about naught point one percent so we can see that the effect of leverage is too amplify your profits to magnify them but this does cut both ways because it can work this way in terms of loss as well now if we consider the same trade but this time as a 10 pip loss instead of a profit then the margin would be $1,000 the same as before the P&L expressed as u.s. dollars is 204 dollars.

But this time it’s a loss instead of a profit and then that loss expressed as a percentage of the margin you put down would be greater than 20% and if we consider at once again to the unleveraged version where you are just simply converting 200,000 US dollars into Swiss francs and back again then that 204 dollar loss expressed as a percentage of the full 200,000 will be around about Nords point 1 percent so there you have that 1 to 200 leverage.

It has magnified your losses in this case so it cuts both ways as I said before in terms of peer now it is always worth bearing in mind the size of the underlying value if you are conscious of the risks it can be a very convenient way to trade because in this example you wouldn’t be tying up all this 200,000 in order to gain that $200,000 exposure so having worked through the numbers for the margin rates for a professional clients.

I should point out that the leverage is lower for retail clients and that’s just there as a protection in terms of that risk aspect that accompanies higher leverage so the margin rates with trading to want to vary according to whether you’re pro or retail and $4 Swiss the pro raise as we said was half a percent and the retail margin rate is 3 point 3 3 percent so that’s a leverage of 1 to 30 rather than that 1 to 200 that we got for the pro account now all accounts with trading to want to start out classified as retail.

You can switch to professional on request subject to trading experience so we’ve now covered trading on margin trading with leverage let’s run through the six other benefits of trading with Forex so number two in our list of benefits is that you can go short as easily as you can go long when trading Forex Forex trees are inherently two-way and as I’m sure you’ve gathered if you’ve been following our basics of forex series if you trade a currency pair there are two currencies involved for example the US dollar against the Swiss franc which we’ve just been looking at now.

Related: How To Trade Forex Currency Pairs-Forex Factory Signals

Whichever way round you decide to trade whether you’re going long or short dollar Swiss it is inherently part of the trade you’re buying one currency and selling the other now you can go short with other instruments say CFDs on shares or safeties on commodities for example but you do sometimes experience restrictions on going shores for example at one point during the financial crisis the US Securities and Exchange Commission the SEC temporarily put a ban on short sales on a list of financial stocks with Forex there are no restrictions on going short.

If you can trade the pair you can go short either one of the pair number 3 on our list is liquidity the forex market is by far and away the most liquid market in the world generally speaking the more liquid and market the more efficient order execution will be so that’s a nice benefit and then number 4 24-hour trading forex market is a truly 24-hour market from Sunday night through to the close of business in New York on Friday night you can trade Forex prices.