Basics of The Forex Market & Currency Pairs-Forex Factory Signals

I thought a good place to start is with a kind of nuts and bolts approach starting at the very beginning so let’s look at a very simple example of exchanging some money as a net pause so here you are at the airport about to go away on holiday to the Mediterranean for a week or two and you decide you’d like to exchange some of your great British pounds to have some holiday spending money in the local currency so you head over to the currency exchange and at the booth on the wall you notice they have a bunch of flags showing and they have prices also showing that they’re prepared to buy and sell different currencies for in sterling now you’re heading to the Med so it’s euros that’s your interest and getting your hands on you can see that it says they sell euros for 1.2 oh one two that’s the rate and this mean that they will sell you one point two oh one two euros for every pound that you give them and you have here four hundred pounds that you want to exchange so they sell you four hundred pounds multiplied by one point two oh one two and that gives you four hundred and eight euros roughly so you’ve sold your four hundred pounds and you’ve bought four hundred and eight euros with it they’ve bought your four hundred pounds.

They’ve sold you four hundred and eight gyros now let’s say a couple of weeks later you’re back from your holes bit of a ten half a stone heavier perhaps and as it turned out you paid for everything with your MasterCard which was priceless and you’ve still got those four hundred and eighty euros stuffed in your wallet now that you’re back in the UK you’d prefer to change it all back to pounds fortunately for you while you were away the Euro has strengthened against the pound and you find that the currency exchange booth at the airport shows that they will now buy euros at a rate of one point zero four nine it’s means that if you give them one point nine euros they will buy it for one pound so you can sell your 408 euros for four hundred and eight / 1.00 for nine which equals four hundred and six pounds you started with four hundred pounds because the exchange rate move in your favor.

You’ve made six pounds no I don’t get bogged down in numbers this early on but very quickly these were the two exchange rates in our example this first one was the exchange rate at which they were willing to sell you euros before you went away then this second one was the exchange rate at which they were willing to buy the euros back from you upon your return now the exchange rate has fluctuated and you were treating your currencies a different way around each time but they’re both a way of expressing the same thing which is how many euros one pound is worth the convention for writing this exchange rates in the forex market is to use three letters to represent each currency and we write it as GBP for the pound and then often with a slash and then EUR for the year it’s a great British Pound to euro and this always means that the exchange rate is showing how many of the second named currency is worth for one of the first named currency so in this first instance here one pound it’s worth one point two oh one two euros and in the second instance one pound is worth one point zero four nine euros and so we can see that the second number in comparison to the first number shows that the pound is worth fewer euro so we could see the pound has weakened or the euro has strengthened now in reality the big difference between the buy and sale prices such as currency exchange.

Boots would make turning a profit like this on likely which is why you would only use a currency exchange booth for changing money to go on a holiday you wouldn’t use it for actually trading forex but regardless the principle that you can make money from fluctuations in exchange rates is at the heart of the forex market so let’s now talk about the forex market what it is and how it works so the forex market is a market that allows participants to exchange one country’s currency for another country’s currency in other words to trade currencies and it is the forex markets and the trading that goes on in that markets that determines exchange rate the forex market is the most actively traded market in the world it is a vast market it is extremely liquid and we’ll look in future.

Some of the benefits of that’s high liquidthe volume the trades on the forex market is in excess of five trillion US dollars per day and that’s far greater than the combined violent volumes of trades that go on with equities on stock exchanges all around the world.

The World Bank estimates the total volume of equities traded in the world in 2018 was 68 points to 1/2 trillion US dollars and that works out as being roughly two hundred and sixty 1 billion US dollars per day so we can see in that comparison how much larger the forex market is it’s somewhere in the order of 20 times larger than the volume of global equities traded each day and the forex market has no single center of operation if you were looking to trade equities let’s say UK equities then trading would center around London on stock exchanges there if you were looking to trade US equities then trading would be centered around New York on stock exchanges there but with the forex market there is no single center trading spread out around the world as we’ll see in a second just how global and market it is and the vast majority of trading doesn’t happen on exchanges the vast majority of trading is off exchange is what we call over-the-counter OTC and the core of the forex market is the inter-bank market the majority of the volume of forex trading is between very large banks where they offer each other favorable exchange rates in terms of the closeness of the buy and sell prices and retail clients can access forex market via CFD and FX brokers as years have gone by the prices that retail clients are have been able to access the exchange rates have been more similar to the interbank market in terms of the closeness of the prices at which you can buy and sell currencies as we’ll see in future.

When we get into looking at what we call the bid-offer spread and it’s this idea that the

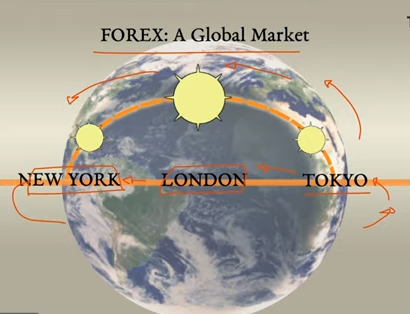

forex market has no central location that allows it to be a truly global market and also a 24-hour market so let’s talk about this now the forex market is a truly global market as we said before trading does not revolve around one single Center instead as the day progresses where the majority of trading occurs will shift across the globe just as the Sun appears to track around the world with trading beginning on any given day in Australasia and financial centers like Sydney there and on to Asian financial centres like Tokyo during European trading hours volumes will pick up in places like Frank Rhodes and London and then later on in the day trading will shift to New York before shifting once again back to Sydney and on to Tokyo for the new trading day and this constant shifting of activity across the globe as days blend from one to another means that the FX market is open for business 24 hours a day the only time it shuts is that the weekend