Chart Patterns Forex

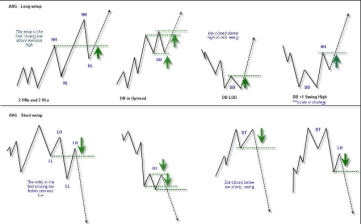

An incredible translation of candle lines in forex exchanging could enormously support our usefulness. Utilizing candle outlines we may see quicker and less complex value inclines, comprehend and estimating some significant market developments. Positively, it’s among the best diagram investigation device. Initially, you’ll need to learn candle examples and furthermore to appreciate the brain research behind them. A fundamental model has a genuine body, a lower and upper shadow. The body speaks to the refinement between the nearby and open cost, known as the range. The shadows demonstrate the least and most elevated expenses of the exchanging session. Whenever cost closes higher than it opens, the semester is bullish and the light’s real body is white.

Whenever cost closes lower than it opens, the semester is bearish and the light’s real body is dishonorable. Long Candle the genuine body of the light is taller\/longer than the shadows, it is a long flame and demonstrates a noteworthy value move. Long white, bullish examples regularly structure near the finish of an uptrend or watching a downtrend, when it is a side effect of an uptrend. Long dark, bearish examples may shape following an uptrend or near this finish of a downtrend, trailed by an expansion. Short Candle A short light can have lower shadows or no shadows.

Much of the time, we may see the little body and longer shadows, called turning top or high wave candles. High Wave Candles, with a strikingly long shadow, appears there was loads of unpredictability amid this session, which means huge benefit openings. You will discover in excess of 60 candle examples, yet just half of them are found normally on the charts. Realizing these examples encourages us, picking this correct open and leave focuses. For more Forex Trading Tips you can visit tyke cash.