Bullish And Bearish Harami

Some of the time recalling the shape and development of the different candle examples can be a dubious activity on the grounds that there are such huge numbers of them. Regularly candle examples can look fundamentally the same as each other and be able to separate the contrast between them all is key for the most right investigation. Luckily for dealers, the harami signals are particularly discernible and this is somewhat because of their name. Harami is the Japanese word for pregnant and if a broker can recollect this, they will recall the arrangement of the example effectively on the grounds that it looks dubiously like a pregnant lady.

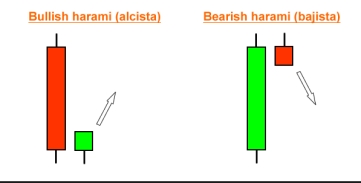

The bullish and bearish harami designs are both the equivalent in nature yet happen toward the finish of various patterns. The bullish harami can regularly be seen toward the finish of a descending pattern and with the pregnant lady correlation, it turns out to be anything but difficult to spot. The principal trademark a broker must pay special mind to is a candle with a long light after the descending pattern. The body of this light should demonstrate that the end cost is lower than the opening cost. The second trademark to finish the example is the accompanying candle that must have a body which is inundated by the last candle. In a perfect world, the shadows of the second candle ought to likewise be overwhelmed by the body of the first to make the example increasingly solid. The second candle should likewise close at a more expensive rate than it opened. The thought behind this development is that the underlying long candle is the mother while the second shorter candle that evades the pattern is the child. At the point when introduced beside one another the candles resemble a pregnant mother.

At the point when this example has been recognized it is plausible that the downtrend will stop and the course of the market will turn around. It demonstrates that selling has ceased and speculators are currently prone to begin purchasing. Then again, the bearish harami can frequently be seen at the opposite end of the scale. All together for a bearish harami to be effectively perceived, there must be a solid uptrend present. The underlying candle from the example must pursue the uptrend and contain a long body while the second candle ought to go the other way of that cost. The body of the second candle should likewise be immersed by the first and its shadows ought to in a perfect world be as well. Basically, the bearish harami is only the bullish harami in turn around and it serves to recommend the market course is probably going to change and head a bearish way. At the point when a broker notification both of these examples it is a decent time to enter the market.

With regards to exchanging inversion, candle designs are the example of decision for some merchants and one of the primary examples you have to learn is the Bullish and Bearish Harami designs.